- Visit

Featured Experience

Experience the world of Walt Disney Studio and explore its contributions to the war efforts in The Walt Disney Studios and World War II exhibition. - Shop & Dine

Hangar Café Online Ordering

Hangar Café has you covered with online ordering. While you walk along on your tour, preorder your food and stop by our air-conditioned café for a little mid-day break!

- Events

For Love of Country Gala

Please join us for Hawaii’s premier patriotic and philanthropic gala, For Love of Country, on Saturday, December 7, 2024. Early Bird Prices available now through August 1st!

- Support

MATCHING GIFT OPPORTUNITY: P-38 LIGHTNING EXHIBITION

Double your impact to create a transformative P-38 Lightning exhibit: a tribute to the heroic pilots and crews of this legendary aircraft that played a pivotal role in WWII.

- Education

Pearl Harbor to Peace

From a Hawaiʻi perspective, your Scout will analyze the factors that led the former adversaries of WWII to build a framework of peace that has endured for over 79 years.

- News

Photo Gallery

Enjoy a look at different photo galleries that shares who we are and what we do!

- About

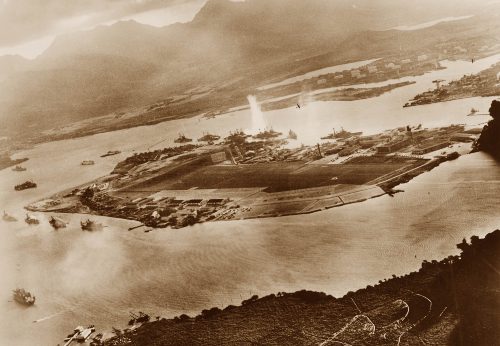

Experience America’s WWII Aviation Battlefield

Located on the ground where bombs first fell on that fateful day, Pearl Harbor Aviation Museum invites you to experience Pearl Harbor like you never have before.

Short sentence to briefly describe menu category.

Short sentence to briefly describe menu category.

Short sentence to briefly describe menu category.

Short sentence to briefly describe menu category.

Short sentence to briefly describe menu category.

Short sentence to briefly describe menu category.